Navigating the Maze of Franchise Bookkeeping

Back To BlogNavigating the world of franchise bookkeeping can feel like wandering through a maze without a map. But fear not, we're here to guide you through the twists and turns of managing your financial landscape with ease. From understanding the basics to avoiding common pitfalls, we've got you covered.

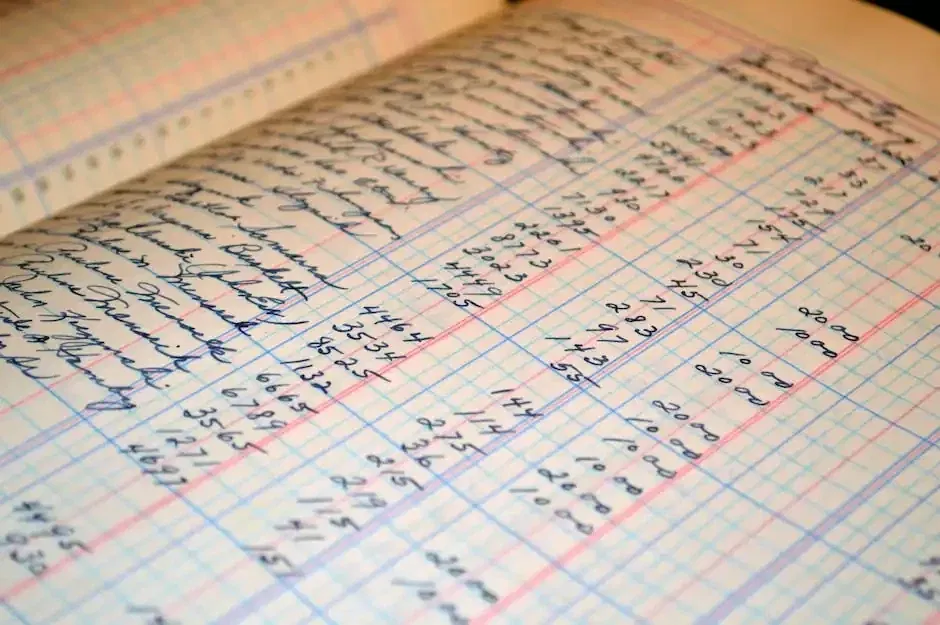

The Basics of Franchise Bookkeeping

Navigating the maze of franchise bookkeeping can seem like a daunting task, but with the right knowledge and tools, it can be a smooth process. At ProvenCFO, we understand the importance of clear and organized finances to help businesses succeed. Here are some key points to consider when managing your franchise bookkeeping:

Understanding Your Financial Landscape

When it comes to franchise bookkeeping, it's essential to have a clear understanding of your financial landscape. This includes knowing your revenue streams, expenses, assets, and liabilities. By having a solid grasp of your financial situation, you can make informed decisions that will benefit your franchise in the long run.

One way to gain insight into your financial landscape is by regularly reviewing your financial statements. These documents provide a snapshot of your business's financial health and can help you identify areas for improvement. At ProvenCFO, we offer transparent services that provide real-time data to help you stay on top of your finances.

The Key Components of Effective Bookkeeping

Effective bookkeeping is crucial for maintaining accurate financial records and ensuring compliance with tax regulations. Some key components of effective bookkeeping include:

- Accurate Record Keeping: Keeping detailed records of all financial transactions is essential for tracking income and expenses.

- Regular Reconciliation: Reconciling bank statements with accounting records helps ensure accuracy and identify discrepancies.

- Budgeting and Forecasting: Creating budgets and forecasts can help you plan for future expenses and revenue.

- Payroll Management: Managing payroll accurately is crucial for keeping employees satisfied and compliant with labor laws.

- Tax Compliance: Staying up-to-date on tax regulations and filing requirements is essential for avoiding penalties.

By focusing on these key components, you can streamline your franchise bookkeeping process and set yourself up for success.

Remember, at ProvenCFO, we are here to support you every step of the way with our stress-free finance services. Whether you need assistance with bookkeeping, payroll, or capital advisory, we have the expertise and technology to help your franchise thrive.

Common Pitfalls in Franchise Bookkeeping

Mixing Personal and Business Finances

One of the most common pitfalls in franchise bookkeeping is mixing personal and business finances. It can be tempting to use the same account for both personal expenses and business transactions, but this can lead to a tangled mess when it comes time to reconcile your books. Keeping your personal and business finances separate is crucial for accurate record-keeping and financial clarity.

Neglecting Regular Financial Reviews

Another pitfall to avoid is neglecting regular financial reviews. It's easy to get caught up in the day-to-day operations of your franchise and forget to take a step back to review your financials. Regular financial reviews can help you spot any discrepancies or issues early on, allowing you to address them before they become major problems. Make sure to set aside time each month to review your financial statements and ensure everything is in order.

Essential Tools for Streamlined Bookkeeping

Navigating the maze of franchise bookkeeping can be overwhelming, but with the right tools in place, it can become a breeze. Here are some essential tools that can help streamline your bookkeeping process:

Software Solutions That Do the Heavy Lifting

When it comes to managing finances for your franchise, having the right software is crucial. At ProvenCFO, we understand the importance of using advanced software solutions to simplify bookkeeping tasks. With our expertise and experience, we recommend utilizing top-notch accounting software like QuickBooks or Xero. These platforms offer features such as automated bank feeds, customizable reports, and seamless integration with other financial tools.

By leveraging these software solutions, you can easily track income and expenses, reconcile accounts, and generate financial statements with just a few clicks. This not only saves time but also ensures accuracy in your financial records.

Automating Repetitive Tasks for Efficiency

Bookkeeping for a franchise involves numerous repetitive tasks that can be time-consuming if done manually. To increase efficiency and reduce errors, consider automating these tasks wherever possible. At ProvenCFO, we advocate for automating processes like invoice generation, expense categorization, and payroll calculations.

By implementing automation tools like Zapier or Bill.com, you can streamline these repetitive tasks and free up valuable time to focus on growing your franchise business. Automation not only improves accuracy but also enhances productivity by eliminating manual data entry and reducing the risk of human error.

In conclusion, by utilizing software solutions that do the heavy lifting and automating repetitive tasks for efficiency, you can navigate the maze of franchise bookkeeping with ease. Let ProvenCFO guide you through this process and help you achieve stress-free finances for your franchise success.

Strategic Planning with Your Books in Mind

When it comes to navigating the maze of franchise bookkeeping, strategic planning is key. At ProvenCFO, we understand the importance of having your books in order to make informed decisions for your franchise business. By keeping a close eye on your financial data, you can identify trends, spot potential issues early on, and plan for the future with confidence.

Budgeting for Growth and Expansion

One of the most crucial aspects of franchise bookkeeping is budgeting for growth and expansion. With accurate financial records in place, you can create realistic budgets that align with your business goals. Whether you're looking to open new locations, invest in marketing efforts, or expand your product line, having a solid budget in place will help you stay on track and make informed decisions.

Forecasting to Stay Ahead of the Curve

In addition to budgeting, forecasting plays a vital role in staying ahead of the curve in the competitive world of franchising. By analyzing historical data and market trends, you can predict future outcomes and adjust your strategies accordingly. This proactive approach will not only help you anticipate challenges but also seize opportunities for growth and success.

Remember, when it comes to franchise bookkeeping, strategic planning is essential. By working with a trusted partner like ProvenCFO, you can streamline your financial processes, gain valuable insights from your data, and set yourself up for long-term success in the franchising industry.

How We Can Help Elevate Your Franchise's Bookkeeping Game

Leveraging Technology for Real-Time Data Access

At ProvenCFO, we understand the importance of having real-time data at your fingertips when it comes to managing your franchise's finances. Our advanced technology allows us to provide you with up-to-date information on your bookkeeping, payroll, and other financial aspects of your business. With this real-time data access, you can make informed decisions quickly and effectively.

Tailored Services to Meet Your Unique Needs

Every franchise is unique, and we recognize that one size does not fit all when it comes to bookkeeping services. That's why at ProvenCFO, we offer tailored services to meet the specific needs of your franchise. Whether you need help with bookkeeping, payroll, bill pay, outsourced CFO services, capital advisory, or systems architecture, we have the expertise and resources to support you every step of the way. Let us customize a plan that works best for your franchise's financial success.

Conclusion

In conclusion, mastering franchise bookkeeping is essential for the success and growth of your business. By utilizing essential tools, strategic planning, and expert guidance, you can elevate your bookkeeping game and stay ahead of the curve in the competitive franchise industry. Don't let the maze of numbers overwhelm you - take control of your finances and watch your franchise thrive.