How My Bookkeeper Transformed My Business Finances

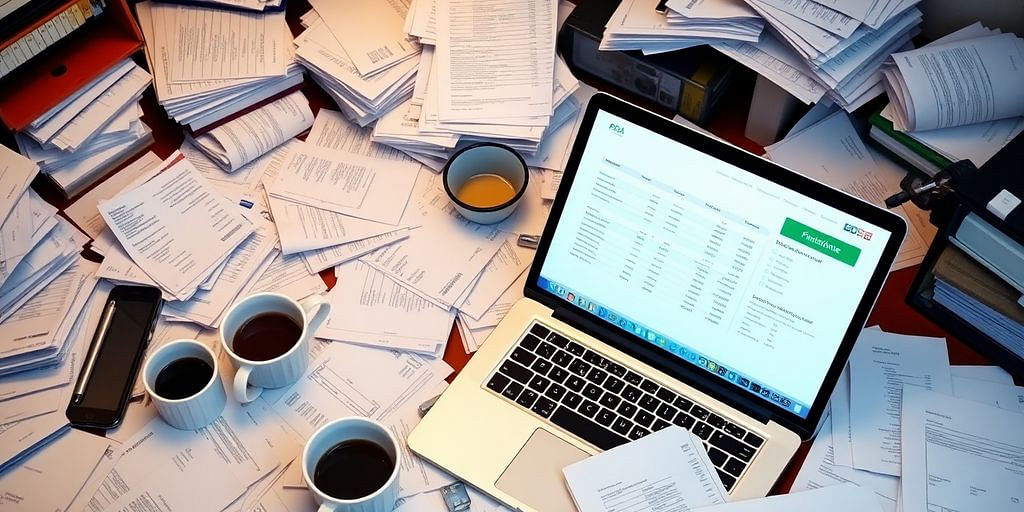

Back To BlogThe Initial Chaos Before My Bookkeeper

Struggling With Spreadsheets

Before we had a bookkeeper, our finances were a mess. We were constantly battling with spreadsheets that seemed to multiply like rabbits. Every month felt like a new puzzle, and we often found ourselves lost in a sea of numbers.

- We had multiple spreadsheets for different expenses.

- Tracking income was a nightmare.

- Mistakes were common, leading to confusion.

Missing Out On Deductions

We were also missing out on important deductions. It felt like throwing money away! We didn’t know what we could claim, and it was frustrating.

- We often overlooked business expenses.

- Tax time was a guessing game.

- We felt like we were losing money without even realizing it.

Overwhelmed By Tax Season

When tax season rolled around, we were completely overwhelmed. It was like a storm hitting us out of nowhere. We scrambled to gather documents and figure out what we owed.

- We spent countless hours preparing.

- Stress levels were through the roof.

- We dreaded the thought of audits.

In those chaotic times, we realized we needed help. The Fluharty Group showed us how to bring order to chaos, bridging the gap between us and our finances.

Discovering the Magic of My Bookkeeper

Finding the Right Fit

When we first started looking for a bookkeeper, we were a bit lost. We wanted someone who understood our needs and could help us get our finances in order. After some searching, we found a bookkeeper who seemed like the perfect match. It felt like a weight was lifted off our shoulders!

The First Few Meetings

In our initial meetings, we discussed our financial chaos and what we hoped to achieve. It was refreshing to have someone listen and offer solutions. We learned about the tools they used, and it was clear they were ready to help us.

Building Trust and Communication

As we worked together, trust grew. We started to feel comfortable sharing our financial details. Regular check-ins helped us stay on the same page. Here’s what we focused on:

- Setting clear goals

- Discussing our concerns openly

- Celebrating small wins

Having a bookkeeper changed everything for us. We went from feeling overwhelmed to having a clear path forward.

In the end, discovering our bookkeeper was a game-changer. We realized that with the right support, we could tackle our finances with confidence and ease. Trust is key in this journey!

How My Bookkeeper Streamlined Operations

Automating Mundane Tasks

When we first started working with our bookkeeper, we were amazed at how much time we could save by automating mundane tasks. Instead of spending hours on data entry and calculations, we now have systems in place that handle these tasks for us. This means we can focus on more important things, like growing our business. Here are some of the key areas where automation has made a difference:

- Invoicing: Our bookkeeper set up automatic invoicing, so we get paid faster.

- Expense Tracking: We can now track expenses in real-time, which helps us stay on budget.

- Reporting: Monthly reports are generated automatically, giving us insights without the hassle.

Creating a Budget That Works

One of the best things our bookkeeper did was help us create a budget that actually works for us. We used to guess how much we could spend, but now we have a clear plan. This has helped us:

- Identify areas where we can save money.

- Allocate funds for important projects.

- Avoid overspending during slow months.

Tracking Every Penny

With our bookkeeper's help, we now track every penny that comes in and goes out. This level of detail has been eye-opening. We can see where our money is going and make better decisions. For example, we learned that we were spending too much on subscriptions we didn’t use. Now, we can cut those costs and invest in things that really matter.

Having a bookkeeper has transformed our financial management. We feel more in control and confident about our decisions.

In summary, our bookkeeper has helped us streamline operations by automating tasks, creating a solid budget, and tracking every penny. This has not only saved us time but also made our financial processes much smoother. We can now focus on what really matters: growing our business!

The Unexpected Benefits of Having My Bookkeeper

Peace of Mind

Having a bookkeeper has given us peace of mind. We no longer worry about missing deadlines or making mistakes. Our finances are in good hands, and that feels great!

More Time for What Matters

With our bookkeeper handling the numbers, we can focus on what we love. Here’s what we’ve gained time for:

- Spending time with family

- Growing our business

- Enjoying hobbies

Confidence in Financial Decisions

Now, we make financial choices with confidence. Our bookkeeper helps us understand our financial situation, so we can plan better. We feel empowered to invest and save wisely.

Having a bookkeeper is not just about keeping track of money; it’s about transforming our entire approach to finances.

In short, the unexpected ways our bookkeeper has saved us time, money, and stress are truly remarkable. We’ve learned that a good bookkeeper does more than just track expenses; they help us make smart choices and avoid costly mistakes before they happen.

Frequently Asked Questions

What were my biggest struggles before hiring a bookkeeper?

Before I got a bookkeeper, I had a hard time managing my finances. I was using spreadsheets, which made everything confusing. I also missed out on important tax deductions and felt stressed every tax season.

How did I find the right bookkeeper for my business?

Finding the right bookkeeper took some time. I looked for someone who understood my needs. In our first meetings, we talked a lot about what I needed and how they could help.

What are some benefits I didn’t expect from having a bookkeeper?

Having a bookkeeper gave me peace of mind. I didn’t have to worry about money as much. Plus, I had more time to focus on my business and felt more confident about my financial choices.