Top Bookkeeping Systems for Small Business: A Comprehensive Guide for 2025

Back To Blog1. Intuit QuickBooks Online

If you're running a small business, Intuit QuickBooks Online is like your financial sidekick. It’s been around for a while, and honestly, there’s a reason it’s still one of the most popular options out there. Whether you’re a newbie to bookkeeping or a seasoned pro, QuickBooks Online has tools that make managing your books feel less like a chore and more like... well, something you can actually handle.

Why We Love It

- Customizable to fit your business needs, whether you're a freelancer or managing a small team.

- Offers multiple versions and add-ons so you can scale up as your business grows.

- Has one of the most user-friendly mobile apps, perfect for on-the-go updates.

Key Features

Things to Consider

- It’s not the cheapest option, so make sure it fits your budget.

- Some advanced features might feel hidden in the mobile app.

QuickBooks Online is a solid pick for small businesses with a bit of wiggle room in their tech budget. It’s flexible, powerful, and makes bookkeeping less intimidating.

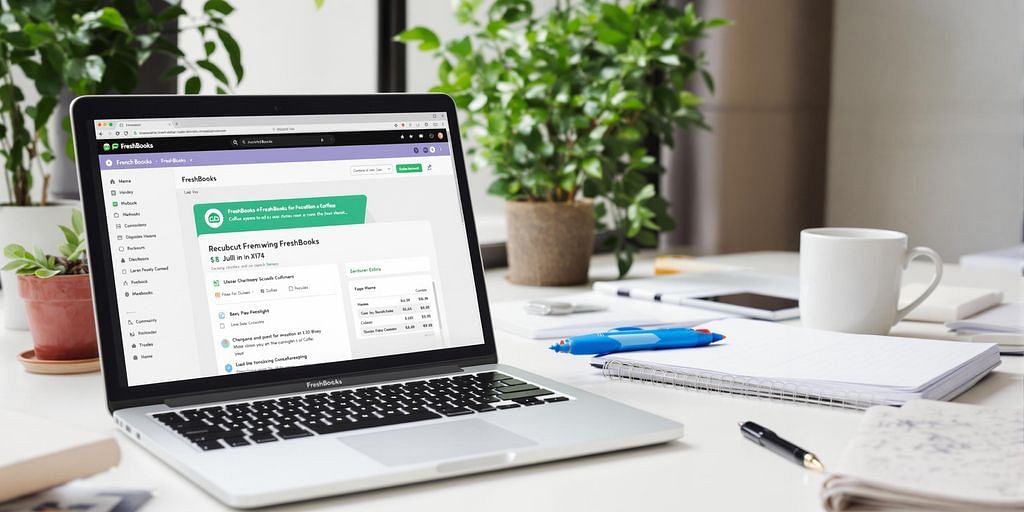

2. FreshBooks

FreshBooks is a go-to for small businesses, especially those in the service industry. It's like having a personal assistant who handles your invoicing, expense tracking, and time management all in one place. If you're tired of juggling spreadsheets and chasing clients for payments, FreshBooks might just be your new best friend.

Key Features

- Customizable Invoices: Make them look sharp with your branding, set up recurring billing, and even send automatic late payment reminders.

- Automated Tasks: From expense tracking to payment reminders, FreshBooks does the boring stuff so you can focus on your business.

- Time Tracking: Perfect for freelancers or anyone billing by the hour. Just start the timer and let FreshBooks do the math.

- Project Management: Collaborate with your team and keep everything organized without needing extra software.

- Mobile App: Manage your books on the go. Whether you're at a coffee shop or in between meetings, you're covered.

Pricing Plans

FreshBooks makes bookkeeping feel less like a chore and more like a breeze. It's not just about numbers; it's about making your life easier.

3. Xero

Xero is one of those tools that makes bookkeeping feel less like a chore. Seriously, it’s that good. Whether you’re a small business owner or managing a growing team, Xero has features that’ll make your life easier.

Key Features

- Live Financial Tracking: Keep tabs on your cash flow in real-time.

- Invoice and Quote Generation: Create and send professional invoices with just a few clicks.

- Expense Claims: Forget those piles of receipts; manage them digitally.

- Inventory Management: Perfect for keeping your stock levels in check.

- Bank Reconciliation: Match your bank transactions with your records effortlessly.

Pricing

Xero’s plans start at $25 per month, making it an affordable choice for small businesses. Here’s a quick breakdown:

Mobile App

Their mobile app is a lifesaver. Whether you’re on a coffee break or traveling, you can manage invoices, check cash flow, and even reconcile transactions on the go.

Xero’s ability to add unlimited users without extra cost makes it a standout choice for growing businesses. Plus, its integration with over 1,000 third-party apps means it’s more than just bookkeeping software—it’s a full-fledged business tool.

Why We Love It

Xero isn’t just about numbers; it’s about making your financial life simpler. From customizable dashboards to advanced reporting, it’s designed to grow with your business. If you’re looking for something reliable, flexible, and packed with features, Xero might just be the perfect fit for you.

4. Wave

Wave is one of those tools that feels like it was made for small business owners who want to keep things simple. It's completely free, which is a huge win for anyone watching their budget. If you’re just starting out or have a small operation, this could be your go-to bookkeeping system.

Why Choose Wave?

- No Cost: The free version lets you track income and expenses, send unlimited invoices, and even set up reminders for late payments.

- Automated Reports: You get access to handy financial reports like profit and loss statements and balance sheets.

- User-Friendly: Perfect for those of us who don’t want to deal with overly complicated software.

Optional Paid Features

If you’re looking for a little more, Wave has a Pro plan. Here’s what it offers:

Wave is a solid choice for very small businesses that need to consolidate bookkeeping without the headaches of high costs or complex features.

Whether you stick with the free version or upgrade to Pro, Wave keeps things straightforward and manageable. It’s a great option for small businesses that don’t log tons of transactions every day.

5. Sage 50 Accounting

Sage 50 Accounting is a desktop-based software tailored for small businesses that need a reliable, feature-rich accounting system. It’s particularly popular among industries like construction and manufacturing, thanks to its advanced inventory and job costing tools.

Key Features

- Double-entry accounting for accuracy and compliance.

- Automatic bank transaction imports and reconciliation.

- Comprehensive inventory management and project tracking.

- Customizable and standard reporting options.

- Cloud backup for secure data storage and remote access.

Pros and Cons

- Pros: Advanced inventory tools, robust reporting, and integration with Microsoft 365.

- Cons: Only available for Windows and lacks a mobile app.

If your business needs serious accounting power and you’re okay without a mobile app, Sage 50 could be a perfect fit. It’s especially great for managing inventory and job costs.

Pricing

Sage 50 starts at around $62 per month for a single user, with plans scaling up to $177 per month depending on the features and number of users. Keep in mind, additional users will increase the cost.

For businesses seeking a dependable desktop solution with strong inventory and reporting capabilities, Sage 50 remains a top choice. Learn more about its recognition as a top-rated accounting software in the 2024 Capterra Shortlist.

6. Zoho Books

Zoho Books is a fantastic choice for small businesses and freelancers looking for a smart and affordable way to handle their accounting. What makes it stand out? Its seamless integration with other Zoho apps, like CRM and project management tools, creates a unified platform for your business needs.

Key Features

- Intuitive invoice and estimate creation

- Automatic invoice reminders

- Expense tracking and bank reconciliation

- Time tracking for projects

- Dynamic inventory management

Pricing

We love how Zoho Books simplifies recurring expenses, like rent or subscriptions, by automating payments and tracking. It’s a real time-saver!

While it’s packed with features, it’s worth noting that Zoho Books doesn’t include a payroll system. You might need to pair it with another tool if payroll is a must-have for you. Still, for its price and flexibility, it’s a solid option for service-based businesses or anyone already using other Zoho products.

7. TallyPrime

TallyPrime is like that reliable friend who always helps you out when managing business finances feels overwhelming. It’s straightforward, efficient, and packed with features that make life easier for small businesses.

Key Features

- User-Friendly Interface: This software keeps things simple, so we don’t get lost in a maze of menus and options.

- Comprehensive Accounting: From invoicing to GST compliance, TallyPrime covers all the bases.

- Inventory Management: Track stock levels, orders, and transactions without breaking a sweat.

Why TallyPrime?

- Cost-Effective: It’s priced flexibly, so whether you’re running a tiny shop or a growing company, it won’t strain your budget.

- Multi-Currency Support: Perfect for businesses dealing with international clients.

- Integration Capabilities: Easily connects with other tools to streamline your workflow.

TallyPrime strikes the perfect balance between simplicity and functionality. It’s designed to help us stay on top of our finances without adding unnecessary stress.

8. Akaunting

Akaunting is a free, open-source bookkeeping solution that’s perfect for small businesses or even freelancers who want to keep their finances in check without breaking the bank. What’s great about Akaunting is that it’s entirely web-based, so you can access it from anywhere. Plus, there’s no need to install anything complicated on your computer.

Why Choose Akaunting?

Here are a few reasons why Akaunting stands out:

- Double-entry accounting is built-in, which means every transaction is automatically balanced with a debit or credit. No manual balancing headaches!

- It supports automatic bank imports, saving you time by syncing your transactions directly.

- You get access to standard accounting reports, like profit and loss statements, balance sheets, and accounts payable/receivable.

What’s the Catch?

Let’s be honest—while Akaunting is free, some advanced features (like integrations with third-party apps) might require a paid add-on. But for basic bookkeeping? It’s a solid choice.

Akaunting makes bookkeeping simple and accessible, even if you’re just starting out. It’s like having a financial assistant that doesn’t cost a dime.

If you’re curious to see what others think, check out the user reviews to get a sense of how it performs in real-world scenarios. Akaunting truly caters to businesses that need flexibility and affordability in one neat package.

9. TurboCASH

TurboCASH is a solid choice for small businesses looking for customizable accounting software without breaking the bank. It's been around for a while, and there’s a reason it still holds its ground in 2025. Let’s break it down.

What Makes TurboCASH Stand Out?

- Multi-Currency Support: If you’re dealing with international clients or vendors, TurboCASH has you covered with its multi-currency feature. No more juggling conversion rates manually.

- Customizable Options: From reports to invoices, you can tweak the software to fit your business needs.

- Free and Open Source: Yep, you read that right. It's open-source, which means you get a lot of flexibility without shelling out a ton of cash.

Pros

- Easy to set up and use.

- Great for businesses on a budget.

- Active community support for troubleshooting and tips.

Cons

- The interface might feel a bit outdated compared to newer software.

- Limited integrations with other tools.

- Not as feature-packed as some premium options.

TurboCASH is proof that you don’t need to spend a fortune to get reliable accounting software that works for small businesses.

If your business needs straightforward accounting with multi-currency capabilities, TurboCASH is worth considering.

10. SlickAccount

SlickAccount is one of those bookkeeping tools that feels like it was designed with small businesses in mind. It’s simple, but not too simple—it’s got enough features to handle the basics without overwhelming you with stuff you’ll never use. If you’re looking for a no-fuss way to manage your finances, this might be a great fit.

Key Features

- Real-Time Tracking: You can keep an eye on your income and expenses as they happen.

- Tax Management: Automatically calculates taxes for you, saving time and headaches.

- Budgeting Tools: Helps you plan your finances better.

Why Choose SlickAccount?

- Affordable Plans: It’s budget-friendly, which is always a plus for small businesses.

- Easy Accountant Access: You can share your financial data with your accountant without any extra fees.

- Customizable Reports: Generate reports that actually make sense for your business.

SlickAccount might not have every bell and whistle, but it’s a solid choice if you want something easy to use and effective. It’s like that reliable friend who always shows up when you need them.

11. NolaPro

NolaPro is one of those hidden gems in the bookkeeping world. It’s not as flashy as some of the big names, but don’t let that fool you—it packs a punch. What makes it stand out is its customizability. You can tweak and tailor it to fit your business needs, whether you’re running a small retail shop or a service-based company. Plus, it’s cloud-based, so you can access it from anywhere.

Key Features

- Customizable modules that let you add or remove features as needed.

- Handles everything from invoicing to payroll, inventory, and beyond.

- Multi-language and multi-currency support.

- Free basic version with optional paid upgrades.

Pros and Cons

If you’re the kind of person who likes to tinker and make things your own, NolaPro might just be your perfect match. It’s a bit of a learning curve, but once you get the hang of it, it’s smooth sailing.

Need help mastering tools like NolaPro? Check out our essential tips for bookkeeping to stay organized and on top of your finances.

12. QuickFile

QuickFile is a standout choice for small businesses that want to simplify their bookkeeping without spending a fortune. It’s affordable, easy to use, and surprisingly powerful for its price point. If you’re tired of juggling spreadsheets or paying for features you don’t need, QuickFile might just be the solution you’ve been waiting for.

Why Choose QuickFile?

- Budget-Friendly: Perfect for startups and small businesses that need solid accounting without the hefty price tag.

- Integration: Works seamlessly with other tools, reducing manual data entry.

- Customizable Chart of Accounts: Tailor your financial reports to fit your business needs.

Features

- Automated Invoicing: Set up recurring invoices and let QuickFile handle the rest.

- Bank Reconciliation: Sync with your bank to keep your records accurate and up-to-date.

- Expense Tracking: Easily monitor where your money is going.

Getting Started

Starting with QuickFile is a breeze. Here’s how you can get up and running:

- Sign up for an account.

- Adjust the settings to suit your business.

- Import your bank statements and start tracking expenses right away.

Quick accounting is essential for small businesses, and QuickFile makes it possible without the complexity or high costs. It’s not just about numbers—it’s about taking control of your financial future.

For small businesses, quick accounting isn’t just a buzzword; it’s a necessity. QuickFile makes the process intuitive and stress-free, giving you more time to focus on what really matters—growing your business.

13. Oracle NetSuite ERP

Oracle NetSuite ERP is like the multitool of bookkeeping systems. This platform is designed to handle complex accounting needs, making it a solid pick for businesses that are scaling up or already managing multiple moving parts. It’s cloud-based, so you can access it anywhere, which is a lifesaver if you’re always juggling tasks on the go.

Key Features

- Automatically posts paid transactions into journals—no more manual entry.

- Combines multiple orders into a single invoice, simplifying payments.

- Offers a streamlined chart of accounts for easier tracking.

- Reduces duplicate entries and adjustments with multi-book capabilities.

- Supports payroll payment schemes tailored to different employee needs.

- Real-time bank reconciliations through its mobile app.

While setting up Oracle NetSuite ERP can take some time, once it’s up and running, it feels like having a financial expert working alongside you.

Pricing

NetSuite doesn’t have a fixed price tag. You’ll need to get a custom quote based on your business’s specific requirements. It’s not the cheapest option out there, but it’s worth considering if you need a system that can grow with your business.

Why Choose Oracle NetSuite ERP?

- Handles multi-currency and multi-company setups with ease.

- Provides robust inventory management and reporting tools.

- Offers strong data security to keep your financial info safe.

If you’re after a bookkeeping system that can do it all, Oracle NetSuite ERP might just be the one.

14. Kashoo

Kashoo is one of those tools that just gets it. If you're a small business owner or freelancer who doesn't want to wrestle with overly complicated software, Kashoo might be your go-to solution. It's all about keeping things simple while still packing in the features you need to stay on top of your finances.

Why We Love Kashoo

- Super Simple Interface: You don’t need to be a tech genius to figure this one out. It’s intuitive and user-friendly.

- Automatic Entries: Forget about typing in every single transaction manually. Kashoo automates a lot of that boring stuff for you.

- Real-Time Collaboration: Work with your team without any confusion. Everyone stays updated in real time.

Key Features

- Invoicing Made Easy: Send invoices quickly and get paid faster.

- Expense Tracking: Keep tabs on your spending without breaking a sweat.

- Tax Compliance: Kashoo helps you stay on top of your taxes, so you’re not scrambling come tax season.

Managing your finances doesn’t have to be a headache. Kashoo is all about making life easier so you can focus on what really matters—growing your business.

If 2025 is the year you’re looking to streamline your accounting, Kashoo is a solid choice. It’s straightforward, affordable, and gets the job done without any fuss.

15. FreeAgent

FreeAgent is one of those tools that makes you go, "Why didn't I start using this sooner?" It's perfect for small business owners who want to keep their finances in check without needing a degree in accounting. Seriously, it's that simple.

Why We Love FreeAgent

- User-Friendly Interface: Even if spreadsheets make you break out in a sweat, FreeAgent keeps things straightforward.

- Automated Invoicing: No more chasing clients! Set it up, and FreeAgent handles the rest.

- Real-Time Insights: Get a clear view of your business finances anytime, anywhere.

Key Features

- Expense Tracking: Snap a pic of your receipt, upload it, and boom—expense logged.

- Tax Management: It organizes everything to make tax season a breeze.

- Project Management: Track your time, manage tasks, and keep everything in one spot.

Pricing

FreeAgent keeps it simple with one pricing plan. It’s not the cheapest out there, but for what it offers, it’s worth every penny.

FreeAgent doesn’t just simplify bookkeeping—it gives us more time to focus on growing our business. That’s a win in our book.

16. GnuCash

GnuCash is one of those under-the-radar bookkeeping systems that can surprise you with its capabilities. It's open-source and free, which is a huge plus for small businesses or freelancers looking to keep costs down. Sure, it might seem a bit old-school at first glance, but once you get the hang of it, it’s rock-solid.

Key Features

- Double-Entry Accounting: Keeps your books balanced, no matter how complex your finances get.

- Scheduled Transactions: Automate recurring payments or bills so you can focus on running your business.

- Multi-Currency Support: Ideal if you’re dealing with international clients or suppliers.

- Customizable Reports: Generate detailed financial reports to track income, expenses, and everything in between.

Why We Like It

We love GnuCash because it’s straightforward once you get past the initial learning curve. It’s like that reliable old bike—maybe not flashy, but it gets the job done. Plus, it’s backed by a community constantly improving the software.

If you’re looking for a free accounting tool that doesn’t skimp on features, GnuCash is worth checking out. It’s especially handy if you’re familiar with bookkeeping basics and want something that grows with your needs.

Pros

- Free to use—no hidden costs.

- Handles both personal and business finances.

- Community-driven with regular updates.

Cons

- The interface feels a bit dated.

- Steeper learning curve for newcomers.

- Limited customer support.

If you're curious about how GnuCash can fit into your business, give it a shot. It might just be the perfect balance between simplicity and power.

17. AccountEdge

AccountEdge has been around for years, and it's still a top pick for small businesses that prefer a desktop accounting system. This software packs in a ton of features to make managing your business finances feel less like a chore.

Key Features

- Invoicing: Simple, efficient, and saves time. You can create and send invoices without overthinking it.

- Payroll: All the tools you need to handle payroll are built right in.

- Banking: Sync your bank accounts so everything stays in one place.

Pricing

AccountEdge Pro is a one-time purchase for $499. They even offer a free 30-day trial so you can test the waters before committing.

If you’re looking for a reliable desktop accounting solution, AccountEdge is a solid choice. It’s got the features to handle most small business needs and then some.

Why Choose AccountEdge?

- Reliability: It’s been a trusted name in accounting for a long time.

- All-In-One: From invoicing to payroll, it covers the essentials.

- No Subscription Fees: Pay once, and it’s yours—no recurring payments to worry about.

18. MYOB Essentials

If you're after simplicity without losing functionality, MYOB Essentials might just be what your small business needs. It's straightforward, user-friendly, and gets the job done without overwhelming you with bells and whistles. Perfect for businesses that want to spend less time managing books and more time doing what they do best.

Key Features

- Double-entry accounting: Ensures your books are balanced and accurate.

- All major A/R and A/P forms: Manage invoices, bills, and payments easily.

- Mobile access: Keep tabs on your finances from anywhere.

- Time tracking: Handy for businesses that bill by the hour.

Why Choose MYOB Essentials?

MYOB Essentials is built for small businesses that need reliable, easy-to-learn software. It doesn’t matter if you’re a newbie or a seasoned bookkeeper—it’s flexible enough to adapt to your needs.

Quick Comparison Table

Looking for a reliable and user-friendly accounting solution? MYOB Business offers effective features that make managing your finances a breeze.

19. Brightbook

If you're a small business owner or a freelancer looking for a no-frills bookkeeping solution, Brightbook might just be your new best friend. This software is completely free and focuses on simplicity, making it perfect for teams of one to five people who don't need to deal with payroll. It's like having a reliable calculator that does exactly what you need—no more, no less.

Why Brightbook Stands Out

- No Payroll Features: If you don't need payroll, why pay for it? Brightbook keeps things lean by skipping unnecessary extras.

- Tailored for Small Teams: Designed with solo entrepreneurs and small groups in mind, so you won't feel bogged down by overly complex tools.

- Free Forever: Yep, you read that right. Manage your finances without spending a dime.

Pros and Cons

Brightbook is a great fit if you're just starting out or if you run a small operation that doesn't need all the bells and whistles. It's straightforward, effective, and won't cost you a penny.

While it may not cater to businesses needing comprehensive financial analysis, Brightbook is a solid choice for those who value simplicity and affordability. Check out how it compares to other options in the market before making your decision.

20. Billy

Billy is a straightforward accounting tool tailored for small businesses and entrepreneurs. Its simplicity is what makes it shine. If you're someone who doesn't want to spend hours figuring out how to manage invoices or track expenses, Billy is a solid pick.

Key Features

- Invoice Management: Create and send professional invoices in minutes.

- Expense Tracking: Keep tabs on your spending without the hassle.

- Cloud-Based: Access your data from anywhere, anytime.

Why Choose Billy?

- Easy to Use: You don’t need to be a bookkeeping wizard to get started.

- Affordable: Great value for small business owners on a budget.

- Time-Saving: Focus on running your business, not crunching numbers.

Sometimes, the best tools are the ones that don’t overcomplicate things. Billy keeps it simple, so you can keep moving forward.

For effective financial organization in 2025, having a system like Billy can really simplify your bookkeeping essentials.

21. Sheetify

Looking for a bookkeeping solution that doesn't make your head spin? Meet Sheetify. It’s a simple yet powerful tool that transforms Google Sheets into a fully functional bookkeeping system. If you’ve ever worked with spreadsheets, you’re already halfway to mastering this.

Why Choose Sheetify?

- No Monthly Fees: One-time payment of $47, and you're set for life.

- Customizable Templates: Pre-filled Google Sheets tailored for small business needs.

- Google Apps Integration: Seamlessly connect with Gmail, Drive, and more.

Key Features

- Income & Expense Tracking: Know where every dollar is going.

- Invoice & Quote Generation: Create professional-looking documents in minutes.

- Goal Tracking: Keep your financial goals front and center.

- Tax Calculations: Make tax season less painful.

- Dashboards: Visualize your financial health at a glance.

Sheetify makes managing finances feel less like a chore and more like a breeze. It’s perfect for small businesses that want something straightforward without hidden costs or complexity.

If you’re already using Google Sheets, Sheetify just makes sense. It’s bookkeeping made easy, affordable, and accessible.

22. ZipBooks

ZipBooks is a solid choice for small businesses looking for simplicity and efficiency in bookkeeping. Its user-friendly interface makes it a favorite for those who want to focus on running their business without getting overwhelmed by accounting software.

Key Features

- Smart Invoicing: Automatically sends invoices and tracks when they’re viewed or paid. Saves you time and hassle.

- Expense Tracking: Helps you monitor where your money is going. You can even upload photos of receipts directly.

- Bank Reconciliation: Syncs with your bank accounts to ensure your records match up perfectly.

- Integrated Time Tracking: Ideal for businesses that bill by the hour.

Pricing

ZipBooks offers a free plan, which is perfect for startups or small businesses on a budget. If you need more advanced features, their paid plans are affordable and flexible.

ZipBooks keeps bookkeeping simple and stress-free, so you can spend less time crunching numbers and more time growing your business.

Why Choose ZipBooks?

If you’re after something easy to use, affordable, and packed with features, ZipBooks could be the bookkeeping tool for you. It’s all about making accounting less of a chore and more of a breeze. Give it a try!

23. Pandle

If you're a small business owner or freelancer, Pandle might just be your new best friend when it comes to managing your books. It's simple, straightforward, and built with small businesses in mind.

Why Choose Pandle?

- Ease of Use: No need to be a tech wizard. Pandle's interface is clean and super intuitive.

- Automated Features: Think bank feeds, transaction matching, and even VAT submissions.

- Cost-Effective: Offers a free version with plenty of functionality, plus an affordable paid plan for extra perks.

Key Features

- Multi-currency support for businesses dealing with international clients.

- Project tracking to keep an eye on profitability.

- Customizable invoicing tools to match your brand.

Pandle takes the headache out of bookkeeping, letting you focus on what really matters—growing your business.

For those looking for affordable bookkeeping packages, Pandle offers a balance of simplicity and functionality that's hard to beat. It's worth a try if you want to streamline your financial management without breaking the bank.

24. SimpleBooks

SimpleBooks lives up to its name. It's designed for small businesses that want to keep things straightforward without sacrificing functionality. If you're tired of overly complicated software, this might be your perfect match.

Why SimpleBooks Stands Out

- Ease of Use: The interface is clean and intuitive, so you won't feel overwhelmed.

- Automated Features: From invoicing to expense tracking, let the software handle the repetitive tasks.

- Affordable: SimpleBooks offers pricing plans that work for tight budgets.

Key Features

"SimpleBooks is like having a personal assistant for your finances—it just works, without the fuss."

If you're new to bookkeeping or just want a no-nonsense solution, SimpleBooks could be the tool you need. For more resources, you might also check out essential accounting books for small business owners. They pair well with tools like this to boost your financial confidence.

25. LessAccounting and more

Let’s talk about LessAccounting and a few other bookkeeping tools that are worth checking out. If you’ve ever felt overwhelmed by overly complicated software, LessAccounting might be a breath of fresh air. It’s designed for simplicity, making it a great pick for freelancers or small businesses that don’t need all the bells and whistles.

Why Consider LessAccounting?

Here’s what makes it stand out:

- Streamlined interface that’s easy to navigate.

- Focus on essential features like invoicing and expense tracking.

- Ideal for users who don’t want to spend hours learning new software.

Alternatives to Explore

If LessAccounting doesn’t quite fit the bill, here are a few other options:

- Brightbook: Perfect for creative professionals who want a free, no-fuss solution.

- Billy: Tailored for small businesses with a focus on simplicity and usability.

- Sheetify: A budget-friendly option that integrates well with spreadsheets.

Sometimes, the best tool is the one that feels natural to use. Don’t overthink it—pick something that matches your workflow and stick with it.

For those just starting out, understanding the basics of bookkeeping is key. Effective bookkeeping is all about staying on top of your finances, and tools like these make it easier than ever. Plus, as we’ve seen in this guide, accounting software can save you from the headache of manual data entry. Why not let technology do the heavy lifting?

Frequently Asked Questions

What does bookkeeping software do for small businesses?

Bookkeeping software helps small businesses manage their finances. It keeps track of income, expenses, and other money-related tasks, like creating invoices and preparing for taxes, all in one place.

Why is bookkeeping software important for small businesses?

Using bookkeeping software saves time and reduces errors. Instead of handling everything manually, the software automates tasks, making it easier to organize and manage your finances.

How can I pick the right bookkeeping software for my business?

Start by thinking about what your business needs. Look at features, ease of use, and cost. Many tools offer free trials, so you can test a few options before deciding on the best fit.