Unlocking Success: The Best Bookkeeping Software for Small Business in 2025

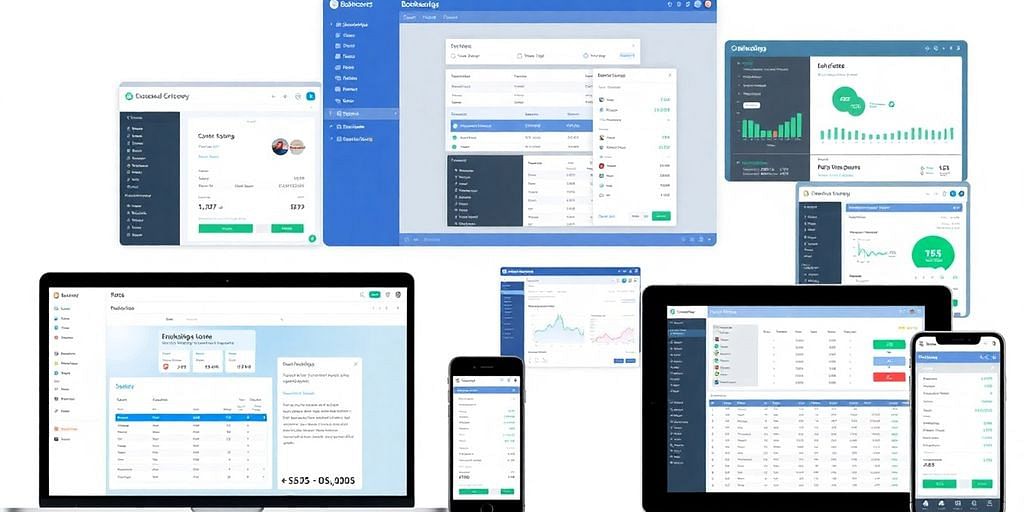

Back To BlogWhy Bookkeeping Software is a Game Changer for Small Businesses

Say Goodbye to Manual Headaches

Let's face it, keeping track of finances manually is a huge hassle. It's time-consuming and leaves too much room for mistakes. By switching to bookkeeping software, we can finally ditch those tedious spreadsheets and piles of receipts. Automating these tasks not only saves time but also reduces errors, making our financial management much more reliable. Imagine spending less time on paperwork and more time on what we love—growing our business!

Real-Time Financial Insights

With bookkeeping software, we gain instant access to our financial data. This means no more waiting until the end of the month to see how we're doing. We can make informed decisions on the fly, adjusting our strategies as needed. This real-time insight into our finances helps us stay on top of things and seize opportunities as they arise. It's like having a financial advisor available 24/7.

Scalability for Growing Businesses

As our business grows, our bookkeeping needs evolve. Manual methods just can't keep up. With the right software, we can easily scale our financial operations. Whether it's adding new users or integrating additional features, the software grows with us. Plus, many options offer tiered plans, so we can upgrade as needed without a hitch. This flexibility ensures we're always ready to handle more business without missing a beat.

Bookkeeping software isn't just a tool—it's a partner in our business journey. It helps us streamline processes, gain valuable insights, and prepare for future growth. Let's embrace the change and set our business up for success.

Top Contenders for the Best Bookkeeping Software in 2025

Choosing the right bookkeeping software can feel a bit like picking the perfect avocado at the store—tricky, but oh so rewarding when you get it right. In 2025, we've got some top contenders making waves in the world of small business bookkeeping. Let's dive into the details of each and see what makes them stand out.

Xero: The All-Rounder

Xero has carved a niche for itself as a versatile tool that suits a variety of business needs. It's like the Swiss Army knife of bookkeeping software. With features like real-time bank feeds, invoicing, and expense tracking, it's equipped to handle the financial chaos of any small business. We especially love how it allows unlimited users without charging extra—perfect for team collaboration. Plus, its intuitive dashboard provides a clear overview of your financial health at a glance, making it a top choice for many small businesses.

QuickBooks: The Industry Giant

QuickBooks is the heavyweight champion in the bookkeeping world. It's like having a financial assistant who's always on duty. This powerhouse software offers invoicing, expense tracking, and even payroll management. Its robust reporting tools give you insights into every corner of your business finances. One of the standout features is its ability to integrate with numerous third-party apps, making it a flexible choice for businesses looking to expand their tech stack. QuickBooks is a safe bet if you want reliability and comprehensive features in one package.

FreshBooks: Perfect for Freelancers

If you're a freelancer or a small business owner wearing many hats, FreshBooks might just be your best friend. It's designed with simplicity in mind, offering easy invoicing, time tracking, and expense management. The user interface is clean and straightforward, making it easy to navigate even if you're not a tech wizard. FreshBooks also offers a handy mobile app, so you can manage your finances on the go. For those who need a straightforward solution without the fluff, FreshBooks delivers.

In the end, the best bookkeeping software is the one that fits your specific needs and budget. Take the time to explore each option and consider what features are most important for your business operations. Remember, the right tool can save you time, reduce errors, and help you focus more on growing your business.

For more insights on choosing the best software for your small business, check out our detailed guide on small business accounting software. It covers a range of options including some of the top picks like Intuit QuickBooks Online, Xero, and FreshBooks, helping you make an informed decision.

Choosing the Right Bookkeeping Software for Your Needs

Identify Your Must-Have Features

Alright, let's get real. Picking the right bookkeeping software isn't just about what everyone else is using. It's about what you need. Start by making a list of must-have features. Do you need invoicing? Expense tracking? Maybe you need something with payroll capabilities or tax prep. Write it all down. Then, think about the nice-to-have features. Those are the ones that'd be cool but aren't deal-breakers. Trust us, this step is super important because it sets the foundation for everything else.

Consider Your Budget

Money talks, right? We all have budgets to stick to, and bookkeeping software is no different. There's a range out there, from free options like Wave to pricier ones like QuickBooks or Xero. Keep in mind not just the upfront cost but also any additional fees for extra users or features. Some software offers discounts if you pay annually, so if you're feeling confident, that might be a way to save a few bucks.

Think About Future Growth

Your business might be small now, but who's to say it won't grow? You need software that can grow with you. Look for options with scalable plans, like Xero, that offer more features as your needs evolve. Also, make sure it can handle more users if your team expands. The last thing you want is to outgrow your software just when things are taking off.

At the end of the day, the right bookkeeping software will not only keep your finances in check but also save you time and headaches. So take your time, try a few out, and see what feels right. It's all about finding that perfect fit for your business.

Tips for Getting the Most Out of Your Bookkeeping Software

Utilize Automation Features

Let's face it, no one likes doing repetitive tasks, especially when they're as tedious as bookkeeping. That's where automation swoops in to save the day. By using automation features in your bookkeeping software, you can let the system handle routine tasks like data entry and transaction categorization. This not only saves time but also reduces the chance of human error. Imagine having more time to focus on growing your business instead of getting bogged down by paperwork.

Regularly Review Financial Reports

Keeping an eye on your financial reports is like getting a health check-up for your business. Regularly reviewing these reports can provide insights into your financial health and help you make informed decisions. Whether it's monthly, quarterly, or annually, setting a schedule to analyze your reports ensures you're never caught off guard by unexpected expenses or cash flow issues. Plus, it helps you spot trends and opportunities for growth.

Integrate with Other Business Tools

Your bookkeeping software shouldn't be an island. By integrating it with other tools like CRM systems, payroll services, or even your calendar app, you create a seamless workflow that enhances productivity. This integration can help streamline processes and ensure data consistency across platforms. It's like having a well-oiled machine where every part works in harmony to keep your business running smoothly.

Remember, the goal is to make your bookkeeping software work for you, not the other way around. By leveraging these tips, you can transform your software from a simple record-keeping tool into a powerful ally for your business growth.

For more insights on managing your business expenses effectively, check out our guide on mastering expenses bookkeeping.

Frequently Asked Questions

What bookkeeping software is best for small businesses?

Some of the top bookkeeping software for small businesses include Xero, QuickBooks, FreshBooks, Wave, and Zoho Books. These tools are designed to help manage finances easily and efficiently.

Is free bookkeeping software good for small businesses?

Free bookkeeping software like Wave or Zoho Books' free plan can be great for startups or very small businesses. However, they might lack advanced features like tax compliance or inventory management.

Can bookkeeping software help with taxes?

Yes, many bookkeeping software options offer features to help with tax preparation, including calculations and reporting. Some even integrate with tax software to make the process easier.